Home Values

The estimated value of your home is

$ XXX,XXX

That means the net worth of the home to you is

If you sold your home today, this is approximately how much you would put in your pocket.

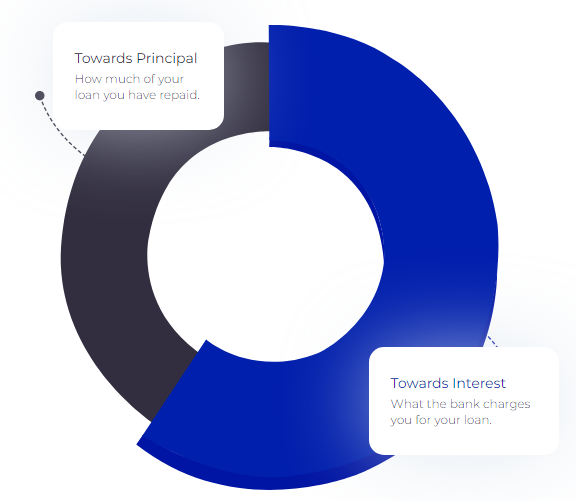

What you’ve paid so far

Every month you make your mortgage payment, you are saving for a rainy day. Your home equity, unlike other retirement plans, can be accessed for investments or emergencies.

Interest Adds Up

Over your 30 year loan you’ll pay $xx,xxx in interest. Here are some tips to get ahead and save some of that interest.

What could a refi save you in interest?

Rates shown below are for example purposes only.

15

15 Year

4.125% Rate – 4.214% APR

- Long term savings

- Payment goes up by $xxxx/month

25

25 Year

4.625% Rate – 4.684% APR

- Long term savings

- Payment goes up by $xxxx/month

30

30 Year

4.625% Rate – 4.676% APR

- Long term savings

- Payment goes up by $xxxx/month

Buy your

dream home

Buy an investment

property

If you bought another home, how much could you afford?

The home equity you’ve earned can be leveraged to build wealth for your family. Does it make sense to rent and buy? Sell and buy? Refinance and invest? We will help you figure out the best strategy to meet your goals!